CONTRACTS WE OFFER

We understand that each one of our producers has unique needs when it comes to selling their grain. That’s why we offer a diverse range of contract options to choose from. Whether you’re looking for immediate cash flow, price protection, or the flexibility to take advantage of market opportunities, we have a contract that can best fit your needs. If you would like to discuss any other contract options than those below, please reach out to our team.

SPOT CASH SALE:

Sell grain at today’s cash price for nearby delivery.

- Advantages

- The exact price is known

- Ability to move grain in short time period

- Cover nearby cash needs

- Disadvantages

- Risk of missed opportunity in the market for higher cash price

- Best time to Use a Spot Cash Sale

- When basis is stronger than normal

- When cash flow is needed

FORWARD CASH CONTRACT:

Producer sells a specific quantity of grain for a specified cash price for a delivery at a later date.

- Advantages

- The exact price you will receive for your grain is established

- The exact quantity of grain to deliver is established

- The Date of delivery is established

- Downside price risk is eliminated

- Disadvantages

- Upside price potential is eliminated for the quantity you contracted

- Contract must be filled even in the case of production shortfall

- Best Time to Use a Forward Contract

- When the Cash price is at an acceptable profit

- When basis is stronger than normal

- When you expect prices to fall

- When you expect supply to be very high (example: harvest)

BASIS CONTRACT:

Producer sells a specific quantity of grain by locking in the basis (difference between CBOT and our cash bid) for delivery at a later date.

- Advantages

- Quantity and Delivery period for exact bushels are established

- Producer eliminates risk of basis widening out

- Opportunity to lock in a higher cash price at a later date if market rises

- Disadvantages

- Producer assumes price risk until futures price is locked in

- Opportunity for basis improvement is eliminated

- Best Time to Use a Basis Contract

- When a price rise is expected

- When basis is stronger than normal

- When there is ample production/stocks of grain

HEDGE TO ARRIVE:

Producer agrees to sell a specific quantity for a certain delivery period and locks in the futures board price for delivery period. A basis will be established at a later time. There is a 5 cent charge per bushel for Hedge to Arrive contract.

- Advantages

- Allows the producer to lock in a futures price if they feel that the board is going to trade lower

- Producer can lock in a basis level at a later time if they feel that basis will tighten up

- Disadvantages

- Producer gives up risk of rises in the market

- Risk of basis widening out

- Best Time to Use a Hedge to Arrive Contract

- When a price decline is expected

- When you expect to obtain a better basis level at a later date

FIRM OFFERS:

Producer makes an agreement to sell a specific amount of bushels if the cash or futures price for a specific delivery period reaches a predetermined level. Firm Offers are in place until the contract is made, or producer calls and cancels the offer.

- Advantages

- Price targets can be reached without having to constantly monitor the market

- Short lived rallies can be taken advantaged of

- Offer can be canceled at any time prior to the offer being filled

- When the market rises significantly and there is a high volume of calls being received, your contract is automatically created. It is not required that you talk to a merchandiser.

- Firm Offers create opportunities for basis to be pushed in your favor for the firm offer to hit

- Disadvantages

- Grain is priced at the offer – additional price potential is eliminated

- Best Time to Use a Firm Offer

- When you feel there will be a rally in the market

- When cash levels are at an acceptable level

- When you feel there may be volatile markets

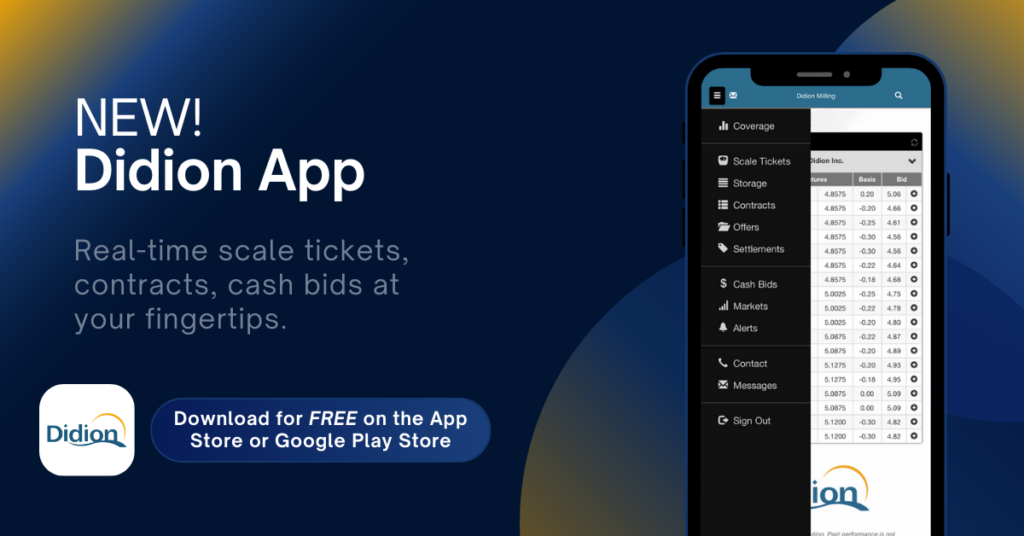

Download the Didion App to stay up to date on the latest on cash bids, real-time scale tickets, contracts, and more!

To view cash bids, real-time scale tickets, contracts and more on your computer, use the following URL:

https://didion.cihedging.com/cih/grower

Sign up for ACH to receive payment up to 4 days faster! Download the ACH application today!